For employers that sponsor a disability benefit plan governed by ERISA, March and April of 2018 represent an important period of time.

Claims filed later than April 1 must be in compliance with a new Department of Labor rule issued back in December of 2016. Among the plans falling under this umbrella are certain qualified retirement plans, health and welfare plans as well as non qualified plans for deferred compensation. The purpose of the new requirements is to boost disclosures to participants in the plans and to increase impartiality of those who make decisions concerning the plans.

Categories Of Affected Plans

In a general sense, the new regulations are applicable toward any plan that falls under the auspices of the Employee Retirement Income Security Act (ERISA). Every plan, including those related to disability benefits, that involves the claims adjudicator of that plan to make disability determinations before rendering a payment decision is part of the new layout. Thus, all employers need to take a fresh look at plans providing benefits, waiver of accrual allocation rules or accelerated vesting due to disability.

Impact On Qualified Retirement Plan Operation

It may be necessary to update retirement plans if their plan administrators are charged with determining disability. But, if such determinations are made by third parties such as the Social Security Administration or other entity, there may be no need for an update.

While it is true that non qualified deferred compensation programs largely fall outside of the ERISA regulations, they are subjected to the statutory claims regulation rules. As such, these plans will require compliance with the new rule if their administrators are the ones to make disability decisions.

Implications For Welfare Plans

The majority of plans covered by ERISA are in fact insured, and therefore broadly speaking, it is the disability carrier’s duty to make changes to claim processes and procedures. Employers and/or plan administrators ought to communicate with the insurers to ensure that coverage certificates will be appropriately updated to achieve compliance with the new rule by April 1 of 2018.

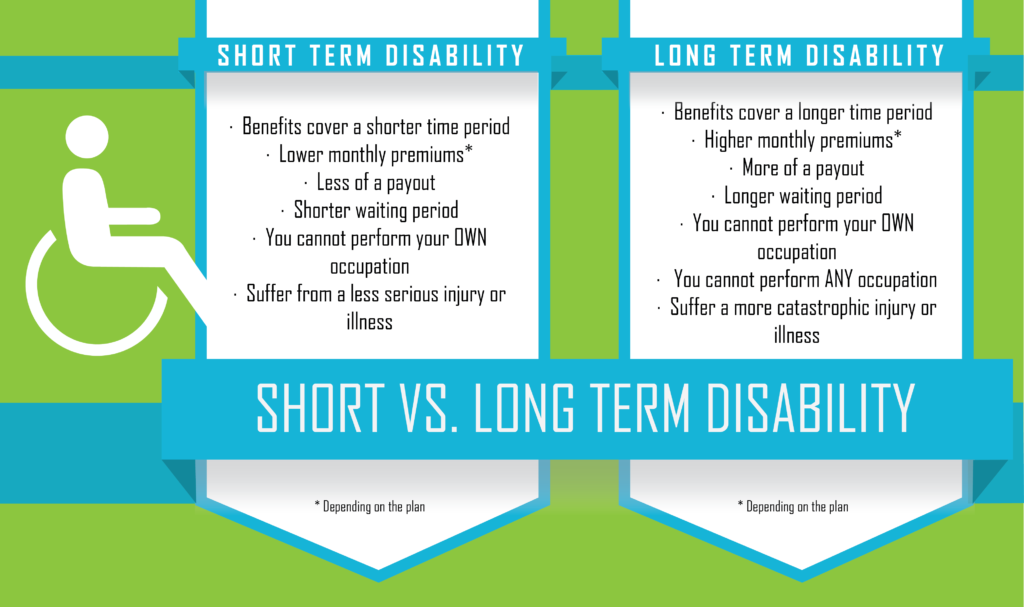

Short-term disability plans that are self-insured and that qualify as a payroll practice may also not require revision, given that they are exempted from ERISA. It should be noted, though, that administrators of such plans may wish to adopt part of even all of the final rule’s provisions, in keeping with best practices. Also, it is important that summary plan description documents and wrap plans be updated and disseminated to all plan participants.

Key Changes Within The New Rule

Every claim and appeal must now receive adjudication in a way that fosters the impartiality and full independence of those making benefit decisions. Much like the rules pertaining to group health care plans promulgated as part of the Affordable Care Act, determinations related to the compensation, hiring, promotion, termination or other issue impacting an adjudicator must never be made with an eye toward the chances that individual will support benefits denials.

Bolstered Disclosure Rules

First, a claim denial, whether at the first denial stage or later as part of an appeal, must have as part of it a discussion about the decision itself. This should include the rationale for any disagreement with the vocational expert, treating doctor or other expert who assessed the claimant; the opinions of experts secured by the plan; and a Social Security Administration disability determination offered to the plan by the claimant.

Furthermore, a denial notice needs to include all guidelines, internal rules, standards and protocols utilized in rendering an adverse claim decision (or in the alternative, a statement that no such criteria exist). There also must be a formal statement that the claimant at issue is entitled to be provided with all relevant documents upon request.

Right To Receive, Review And Refute New Facts Prior to Decision

So that all reviews are full and fairly rendered, plans are required to give claimants all new evidence or rationales used in making the benefit determination. This material must be provided to the claimant immediately and with enough advance time before the decision date so that a response by the claimant is possible. This way, claimants have an opportunity to present their side at the level of an administrative appeal instead of having to wait until the issuance of a denial.

Exhaustion Of Remedies

In cases where a plan has not met all of the claim procedural requirements, normally a claimant would have been declared to have exhausted all available administrative remedies and a lawsuit against the plan could be commenced. But, plans can still be in compliance if their rule violation was deemed non-prejudicial, de minimis, the result of good cause or something the plan could not control, made in the context of a good faith exchange and not part of an overall pattern of violation.

Rescission of coverage is in and of itself an adverse benefit adjudication. Rescission of disability coverage made retroactively is also an adverse determination and is subject to the appeals process. It must be noted that termination of coverage because of premium nonpayment does not equate to a coverage rescission.

It is necessary for all notices to be rendered in a manner that is both linguistically and culturally proper. In the same vein as the ACA rules pertaining to group health care plans, if the relevant claimant’s address of record is within a country with more than 10 percent non-English speakers, claim denial documents must be accompanied by a statement in the appropriate language, indicating how language interpretation services may be accessed.

It is necessary for all notices to be rendered in a manner that is both linguistically and culturally proper. In the same vein as the ACA rules pertaining to group health care plans, if the relevant claimant’s address of record is within a country with more than 10 percent non-English speakers, claim denial documents must be accompanied by a statement in the appropriate language, indicating how language interpretation services may be accessed.

Disclosures Regarding Contractual Limitations Time Frame

Plans with restrictions on the time period available for claimants to file lawsuits need to include on their denial notices information regarding this limit. For instances, if the relevant state has a normal limitations period of five years, but the plan’s contract states that the period is just three years, denial notices must state this fact along with the exact expiration date. Best practices suggest that this type of notice should also accompany denial notices for group health plans and other plans.

Ultimately, every employer potentially affected should make certain to review the new regulations alongside their plan documents to ascertain which rules are relevant to their activities. Furthermore, updates to SPDs should be promptly undertaken in order to achieve full compliance with the new disclosure measures outlined above.

Does this all sound complicated?

Benefits Compliance Consultants Inc. make ERISA compliance easy with system processes that allow you and your employees to sleep better and work harder during the day or night.

We are your one-stop for any and all From 5500 preparation. Need assistance for DOL Audit of your business or want to protect yourself before you have one? We can help with that too.

We are plan document specialists that can help you and your business save time and money.

Contact us today by phone or email at top or bottom of this page.

Need quote for services click here.